Foreign

Trade Procedure 2015-20

CHAPTER

3

EXPORTS

FROM INDIA SCHEMES

(Relevant Policy

Chapter 3)

3.01

Merchandise Exports From India Scheme (MEIS)(a)

Policy for Merchandise Exports from India Scheme (MEIS) is given in Chapter

3 of FTP.

5[(b) An application for claiming rewards under MEIS Merchandise Exports from India Scheme on

exports (other than Export of goods through courier or foreign post

offices using e-Commerce) shall be filed online, using digital

signature, on DGFT website at http://dgft.gov.in with RA concerned in

ANF 3A. The relevant shipping bills and e-BRC Electronic Bank Realisation Certificate shall be linked with the

online application.

However, if

i. E-BRC Electronic Bank Realisation Certificate has been generated in INR and payment is under Para 2.52(b) of

the FTP, a letter from the concerned bank is required to be

submitted to the concerned RA confirming that the payment has been

received through Vostro Mechanism,

or

ii. The shipment has been made to countries which are in OFAC list and e-BRC Electronic Bank Realisation Certificate could not be generated by the concerned bank, a declaration to that

effect by the exporter along with a self attested copy of the proof of

payment such as Foreign Inward Remittance Certificates/Statements etc is

required to be submitted to the RA,

The RAs would process the application under (i) and (ii) above, after

the required documents are submitted in hard copy to the RAs.]

[helldod old[(b) An application for claiming rewards under MEIS Merchandise Exports from India Scheme on exports (other than Export of goods through courier or foreign post

offices using e- Commerce), shall be filed online, using digital signature,

on DGFT website at http://dgft.gov.in with RA concerned in

ANF 3A. The

relevant shipping bills and e-BRC Electronic Bank Realisation Certificate shall be linked with the on line application.helldod]]

2(c)

If application is filed for exports made through EDI ports including SEZ

exports, then the RAs shall not ask for any physical documents except under the

provisions of Para 3.01 (h) below and therefore hard copy of the following

documents need not be submitted to RA: hard copy of applications to DGFT,

EDI/ SEZ shipping bills, electronic Bank Realisation Certificate (e-BRC) and RCMC Registration-cum-Membership Certificate.

The applicant shall submit the proof of landing in the manner prescribed under

paragraph 3.03 of HBP

old[(c) If application is filed for exports made

through EDI ports, then the RAs shall not ask for any physical documents except under the provisions of para 3.01 (h) below and therefore hard copy

of the following documents need not be submitted to RA: hard copy of

applications to DGFT, EDI shipping bills, electronic Bank Realisation

Certificate (e-BRC) and RCMC Registration-cum-Membership Certificate. The applicant shall submit the proof of

landing in the manner prescribed under paragraph 3.03

of HBP.]

2(d)

In case application is filed for exports made through non EDI ports (other than SEZs), then applicant need to submit export promotion copy of non EDI shipping

bills. The applicant shall submit the proof of landing in the manner prescribed

under paragraph 3.03 of HBP. The applicant shall upload scanned copies of any

other prescribed documents for claiming scrip unless specified otherwise.

However applicant need not submit hard copy of applications to DGFT, electronic

Bank Realisation Certificate (e-BRC) and RCMC Registration-cum-Membership Certificate in this case also

old[(d) In case application is filed for exports

made through non EDI ports, then applicant need to submit export promotion copy of non EDI shipping bills. The applicant shall submit the proof of

landing in the manner prescribed under paragraph 3.03 of HBP. The applicant

shall upload scanned copies of any other prescribed documents for claiming scrip unless specified otherwise. However applicant need not submit hard

copy of applications to DGFT, electronic Bank Realisation Certificate (e-BRC)

and RCMC Registration-cum-Membership Certificate in this case also.]

(e) Applicant shall file separate application

for each port of export in case of Non EDI Shipping bills. In case of EDI

shipping bills, the applicant can file a single application containing

shipping bills of different EDI ports. Accordingly shipments from different

EDI ports will not require separate applications

(f) Processing of Non EDI Shipping bills at

RA: In cases the Non EDI shipping bills or the shipping bills not received

through the Message Exchange from Customs, concerned RA shall verify the

details entered by the exporter from the original shipping bills before

grant of scrip.

(g) No manual feeding allowed for EDI

shipments: For EDI Shipping Bill, no manual feeding of Shipping bill details

shall be allowed to the applicants in the online system. Rewards will be

granted by RAs without the need for cross verifying EDI Shipping Bill

details.

(h) RA shall process the electronically

acknowledged files and scrip shall be issued after due scrutiny of

electronic documents. After scrutiny, if the officer has reasonable

suspicion of wrong classification/ mis-declaration in any application, in

such cases officer may, after approval of his senior officer/ Head of the

Office, seek physical documents for scrutiny. On receipt of such documents,

the officer must decide the claim within 7 working days. In cases, where the

claim is rejected, a speaking order shall be issued.

(i) The documents which are not required to

be submitted in original, shall be retained by the applicant for a period of 3 years from the date of issuance of scrip or as prescribed under FTP para

3.19 (b).

(j) Licensing Authority may call such

documents in original at any time within 3 years. In case the applicant

fails to submit the original documents on demand by Licensing Authority the

applicant shall be liable to refund the rewards granted along with interest

at the rate prescribed under Section 28 AA of Customs Act 1962, from the date of issuance of scrip.

(k) Eligibility of product, corresponding ITC (HS) code, and markets (as given in

Appendix 3B) for claiming rewards under MEIS Merchandise Exports from India Scheme shall be determined from Let Export Date as per Paragraph 9.12 of

HBP.

6[(L) The

excess/undue claims paid to the exporters under MEIS Merchandise Exports from India Scheme, for exports with Let Export date between the period 07.03.2019 to

31.12.2019, relating to apparel and made- ups (chapter 61, 62 and 63) will be

suitably adjusted against RoSCTL and recoveries made, wherever due.]

3.02

Applications for Export of goods through courier or foreign post offices

using e-Commerce

(a)

Application shall be filed online, using digital signature, in

ANF 3D by

exporter. The applicant shall submit the proof of landing in the manner

prescribed under paragraph 3.03 of HBP.

(b) Applicant shall file separate application

for each port of export.

(c) RA will manually examine the submitted

documents before grant of scrip.

3.03

Proof of Landing

(a)

Wherever the reward under MEIS Merchandise Exports from India Scheme is available to all countries, proof of

landing shall not be required to be submitted for claiming the reward

(b) Uploading/submission of documents, as a

proof of landing:

As a measure of ease of doing business,

documents as a proof of landing of export consignment in notified market can

be digitally uploaded in the following manner:-

(i) Any exporter may

upload the scanned copy of document as mentioned at paragraph 3.03 (c) (i)

under his digital signature.

(ii) Status holders

falling in the category of Three Star, Four Star or Five Star export house

category may upload scanned copies of documents as mentioned at paragraph

3.03(c) (iv).

(iii) In all other

cases the physical copy, in original, shall be filed by all categories of

exporters.

(c) Applicant shall be required to submit or

upload, as the case may be, any one of the following documents as a proof of

landing of export consignment in notified Market:

(i) A self

attested copy of import

bill of entry filed by importer in specified market,

or

bill of entry filed by importer in specified market,

or

(ii) Delivery

order issued by port authorities, or

(iii) Arrival

notice issued by goods carrier, or

(iv) Tracking

report from the goods carrier (Shipping Line/Airline etc. or his accredited

agent in India) duly certified by them, evidencing arrival of export cargo

to destination Market, or

(v) For Land

locked notified Market, Rail/Lorry receipts of transportation of goods from

Port to Land locked notified

Market,

(vi) Any other

document that may satisfactorily prove to RA concerned that goods have

landed in / reached the notified Market.

(d) In case of (iv) and (vi) above, the

accredited agent of the Goods Carrier must certify that he is the accredited

agent of the concerned Goods Carrier on the date of issuance of the tracking

report / document.

(e) Further, in the case of issuance of any

other document under (vi) above, the accredited agent must state that proof of landing of goods in relevant notified Market is given based on

information available in the Goods Carrier’s backup database and he has

verified the same and issued this document accordingly.

(f) In cases of exports using e commerce,

exporter may submit express operator landing certificate/online web

tracking

print out indicating airway bill number as prescribed in enclosure (B) to

ANF 3D.

3.04

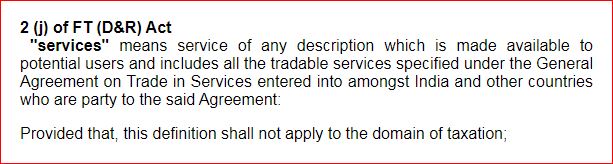

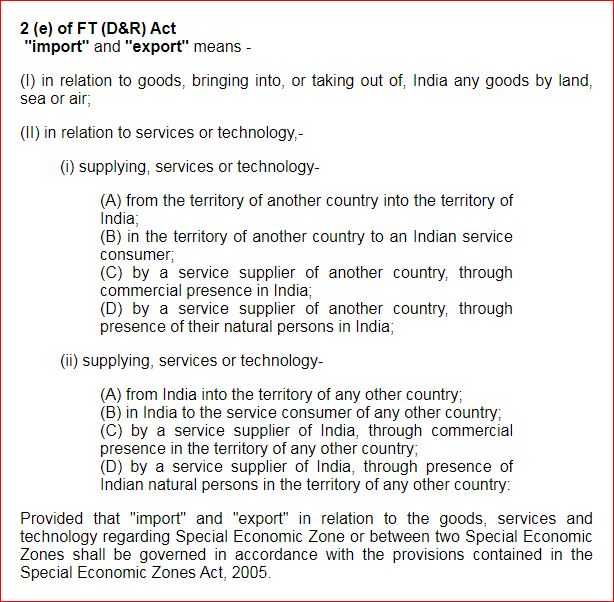

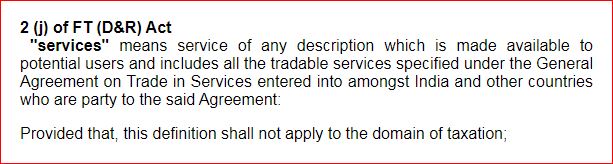

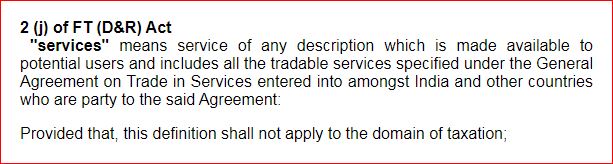

Service Exports From India Scheme (SEIS)

(a)

Policy for Service Exports From India Scheme (SEIS) is given in Chapter 3 of

FTP

*(b) An application for grant of duty credit

scrip for eligible services

rendered shall be filed online for a financial

year on annual basis in ANF 3B using digital signature.

rendered shall be filed online for a financial

year on annual basis in ANF 3B using digital signature.

(c) RA shall process the application received

online after due scrutiny.

Common Procedural features applicable

to MEIS Merchandise Exports from India Scheme and SEIS Service Exports from India Scheme, unless specifically provided for:

3.05

Transitional Arrangement

(a) For the goods exported or services

rendered upto the date of notification of current Foreign Trade Policy,

which were otherwise eligible for issuance of scrip under erstwhile

chapter 3 of the earlier Foreign Trade Policy(ies) and scrip is applied

on or after the date of notification of current Foreign Trade Policy

against such export of goods or services

rendered upto the date of notification of current Foreign Trade Policy,

which were otherwise eligible for issuance of scrip under erstwhile

chapter 3 of the earlier Foreign Trade Policy(ies) and scrip is applied

on or after the date of notification of current Foreign Trade Policy

against such export of goods or services

rendered, the application shall

be made to Jurisdictional RA in the form with documents as prescribed in the HBP v I 2009-2014.

rendered, the application shall

be made to Jurisdictional RA in the form with documents as prescribed in the HBP v I 2009-2014.

(b) Deleted.

(c) Applicants shall continue to file

applications in respect of FPS/ MLFPS/FMS/VKGUY/SFIS/SHIS/IEIS and Agri

Infrastructure Incentive Scheme Scrip in the application form and manner

prescribed in the corresponding Hand Book of Procedures

*3.06

Jurisdictional RA / RA Concerned

*(a)

Applicant shall have option to choose Jurisdictional RA on the basis of

Corporate Office/ Registered Office/Head Office / Branch Office address

endorsed on IEC for submitting application/applications under MEIS Merchandise Exports from India Scheme and

SEIS Service Exports from India Scheme.

This option need to be exercised at the beginning of financial year. Once an

option is exercised, no change would be allowed for claims relating to that

year. To illustrate, if an exporter has chosen RA Chennai for claiming

rewards for exports made in 2015-16,then all claims for exports made in

2015-16, irrespective of the date of application shall be made to RA Chennai

only.

(b) Jurisdiction for MEIS Merchandise Exports from India Scheme

| 1 |

2 |

3 |

| Sl No |

Units |

Jurisdictional RA |

| (i) |

Importer Exporter Code (IEC)

Holders having units in DTAs/ EHTPs/ BTP Biotechnology Parks/ STPs or more than one of

these |

Jurisdictional RA of DGFT as in

Appendix 1A |

| (ii) |

IEC Holders having units

in SEZs/EOUs or both |

Respective Development Commissioner

of Special Economic Zones (SEZs) as in

Appendix 1A |

| (iii) |

IEC Holders having units

both in (i) and (ii) above |

Units located in category (i) and

(ii) will apply to respective jurisdictions at Col -3 |

*(c ) Jurisdiction for

SEIS Service Exports from India Scheme (Single

Application on Annual Basis)

| 1 |

2 |

3 |

| Sl No |

Units |

Jurisdictional RA |

| (i) |

Importer Exporter Code (IEC)

Holders having units only in DTAs |

Jurisdictional RA of DGFT as in

Appendix 1A |

| (ii) |

IEC Holders having units

only in SEZs |

Respective Development Commissioner

of Special Economic Zones (SEZs) as in

Appendix 1A |

| (iii) |

IEC Holders having units

in Multiple SEZs |

Single application for all units to

the Development Commissioner of the SEZ where it has achieved

highest Forex Earnings |

| (iv) |

IEC Holders having units

both in DTA and SEZs |

Single Application for all different

units to the Jurisdictional RA of DGFT as given in

Appendix 1A

|

3.07

Applicability of Provisions contained in Chapter 2 and 9 of this HBP

Provisions contained in Chapter 2 and 9 of this HBP shall apply to MEIS Merchandise Exports from India Scheme and

SEIS Service Exports from India Scheme.

3.08

Port of Registration of Scrips

(a)

Port of Registration under MEIS Merchandise Exports from India Scheme would be as follows:

(i) Duty Credit Scrip

(including splits) under MEIS Merchandise Exports from India Scheme shall be issued with a single port of

registration which shall be any one of the EDI ports from where export is

made. In case of shipments from Non EDI ports, the Duty Credit Scrip

(including splits) under MEIS Merchandise Exports from India Scheme shall be issued with a single port of

registration which shall be the port of export.

(ii) Duty credit

scrip needs to be registered at the port of exports. This is to be done

prior to allowing usage of duty credit. Once registered at EDI port, scrip

can be automatically used at any EDI port for import

and at any manual port

under Telegraphic Release Advise (TRA) procedure.

and at any manual port

under Telegraphic Release Advise (TRA) procedure.

(iii) In case port of

registration is a manual port, TRA Telegraphic Release Advice shall be required for

import

at any

other port.

at any

other port.

(iv) SEZs being non-EDI

Ports, the scrip shall be registered at the SEZ port and in case the scrip

holder intends to use the scrip for import

from another port, the concerned

DC Development Commissioner shall issue Telegraphic Release Advice (TRA).

from another port, the concerned

DC Development Commissioner shall issue Telegraphic Release Advice (TRA).

(b) In case of scrip applied under Service

Exports from India Scheme, the applicant can choose any port as port of

registration and mention it in the application at the appropriate column. RA

will issue the scrip with such port of registration. Such Duty credit scrip

needs to be registered at the port of registration of duty credit. Once

registered at EDI port, scrip can be automatically be used at any EDI port

for import

and at any manual port under Telegraphic Release Advise (TRA)

procedure. In case port of registration is a manual port, TRA Telegraphic Release Advice shall be

required for imports

and at any manual port under Telegraphic Release Advise (TRA)

procedure. In case port of registration is a manual port, TRA Telegraphic Release Advice shall be

required for imports

at any other port.

at any other port.

4[(c)

However, for all MEIS Merchandise Exports from India Scheme/SEIS Service Exports from India Scheme scrips issued on or after 10.04.2019 (except for

MEIS Merchandise Exports from India Scheme/SEIS Service Exports from India Scheme issued with port of registration as one of the Non EDI or

SEZ

ports), Telegraphic Release Advice (TRA ) facility from EDI ports to non EDI

and SEZ ports would not be available.]

3.09

Facility for Split Scrips

(a) On

request, split certificates of Duty Credit Scrip subject to a minimum of Rs.

5 Lakh each and multiples thereof may also be issued, at the time of

application.

(b) Once Duty Credit Scrip has been issued,

request for splits can be permitted with same port of registration as

appearing on the original Scrip. The above procedure shall be applicable

only in respect of EDI enabled ports.

(c) In case of export through non-EDI ports,

the facility of splits shall not be allowed after issue of Scrip.

3.10

Procedure to upload documents by Chartered Accountant / Company Secretary /

Cost Accountant

(a) In

order to move towards paperless processing of reward schemes, an electronic

procedure is being developed to upload digitally signed documents by

Chartered Accountant / Company Secretary / Cost Accountant. Such documents

like annexure attached to ANF 3B,

ANF 3C and

ANF 3D, which are at present

signed by these signatories, can be facilitated by this procedure.

(b) Till such time it is made mandatory to

upload these annexure digitally, such annexure attached to

ANF 3B,

ANF 3C,

ANF 3D would continue to be submitted in physical from to RA.

(c) Exporter shall link digitally uploaded

annexure with his online applications after creation of such facility.

3.11

Import

from private / public Bonded warehouses

from private / public Bonded warehouses

Entitlement can be used for import

from private / public bonded warehouses

subject to fulfilment of paragraph 2.36 of FTP and terms and conditions of

DoR Department of Revenue notification.

from private / public bonded warehouses

subject to fulfilment of paragraph 2.36 of FTP and terms and conditions of

DoR Department of Revenue notification.

3.12

Re-export of defective / unfit goods

Goods

imported which are found defective or unfit for use, may be reexported, as

per DoR Department of Revenue guidelines. Where Duty Credit Scrip has been used for

imports

,

Customs shall issue a certificate containing particulars of Scrip used, date

of import

,

Customs shall issue a certificate containing particulars of Scrip used, date

of import

of re-exported goods and amount debited while importing such

goods. Based on this certificate, upon application, a fresh Scrip shall be

issued by concerned RA to extent of 98% of debited amount, with same port of

registration and valid for a period equivalent to balance period available

on date of import

of re-exported goods and amount debited while importing such

goods. Based on this certificate, upon application, a fresh Scrip shall be

issued by concerned RA to extent of 98% of debited amount, with same port of

registration and valid for a period equivalent to balance period available

on date of import

of the defective / unfit goods.

of the defective / unfit goods.

3.13

Validity period and Revalidation

1[Duty

Credit Scrip issued on or after 01.01.2016 under chapter 3 shall be valid

for a period of 24 months from the date of issue and must be valid on the

date on which actual debit of duty is made. Revalidation of Duty Credit

Scrip shall not be permitted unless covered under paragraph 2.20(c) of HBP.]

old[Duty

Credit Scrip shall be valid for a period of 18 months from the date of issue

and must be valid on the date on which actual debit of duty is made.

Revalidation of Duty Credit Scrip shall not be permitted unless covered under

paragraph 2.20(c) of HBP.

]

8[However, Duty Credit Scrips

issued between 01.03.2018 and 30.06.2018 shall be valid till 30.09.2020.]

Refer

Vide:- Notification No. /2018 Dt.21.02.2018

3.14 Procedure for Declaration of Intent on EDI

and Non EDI shipping bills for

claiming rewards under MEIS Merchandise Exports from India Scheme including export of goods through courier or

foreign post offices using e-Commerce

ReferTrade

Notice 24/2018 Dt.21.02.2018

(a) (i) EDI Shipping Bills:

Marking/ ticking of “Y’ (for Yes) in “Reward” column of shipping bills

against each item, which is mandatory, would be sufficient to declare

intent to claim rewards under the scheme. In case the

exporter does not

intend to claim the benefit of reward under Chapter 3 of FTP exporter

shall tick “N’ (for No).

Such marking/ticking shall be required even for

export shipments under any of the schemes of Chapter 4 (including

drawback), Chapter 5 or Chapter 6 of FTP.

(ii)

Non-EDI Shipping Bills: In the case of non-EDI Shipping Bills, Export

shipments would need the following declaration on the Shipping Bills in

order to be eligible for claiming rewards under MEIS Merchandise Exports from India Scheme: “We intend to

claim rewards under Merchandise Exports From India Scheme (MEIS)”. Such

declaration shall be required even for export shipments under any of the

schemes of Chapter 4 (including drawback), Chapter 5 or Chapter 6 of FTP.

(b) Whenever there is a decision during

the financial year to include any new product/goods or new markets then

to avail such rewards:

(i) For

exports of such products/goods, to such markets, a grace period of one

month from the date of notification/public notice will be allowed for

making this declaration of intent.

(ii) After

the grace period of one month, all exports (of such products/goods or to

such markets) would have to include the declaration of intent on all

categories of shipping bills.

(iii) For

exports made prior to date of notification/public notice of

products/markets, such a declaration would not be required since such

exports would have already taken place.

3.15

Last date of filing of application for Duty Credit Scrips

(a)

Application for obtaining Duty Credit Scrip under MEIS Merchandise Exports from India Scheme shall be filed within

a period of :

(i)

Twelve months from the Let Export (LEO) date or

(ii)

Three months from the date of :

(1) Uploading of EDI shipping bills onto the DGFT server by Customs.

(2) Printing/ release of shipping bills for Non EDI shipping bills.

whichever is

later, in respect of shipments for which claim is being filed.

10[Further, MEIS Merchandise Exports from India Scheme applications for Shipping bills with Let Export date from

01.04.2019 to 31.03.2020 can be submitted without any late cut upto 30.09.2021.

However any such application submitted after 30.09.2021, the last date for

submitting applications shall be as per para 3.15 (a) (i) above and late cut

applied accordingly.]

7[However

with respect to para 3.15(a)(1) above, for the shipping bills where the Let

Export (LEO) date falls during the period 01.02.2019 to 31.05.2019,

applications may be filed within a period of 15 months instead of 12

months.]

(b) For SEIS Service Exports from India Scheme, the last date for filing

application shall be 12 months from the end of relevant financial year of

claim period.

7[However,

the last date for filing SEIS Service Exports from India Scheme applications for FY 18-19 shall be

31.12.2020.]

Refer vide:-

Trade Notice No. 30/2015-20 Dated

01/09/2020

3.16

Application for Shipments from EDI Ports and Non-EDI Ports under MEIS Merchandise Exports from India Scheme

(a)

Shipments from EDI Ports and Non-EDI Ports cannot be clubbed in one

application.

(b) Port of registration for EDI enabled

ports shall be any one of the ports from where export is made.

(c) In case of exports through non-EDI port,

the port of registration shall be the relevant non EDI port of exports.

Accordingly separate application shall be filed for each non EDI port.

(d) Multiple applications can be filed and

supplementary cut shall not be applicable. However, an application can be

filed with upto a maximum of 50 shipping bills.

3.17

Risk Management System

The

policy relating to Risk Management System is given in Paragraph 3.19 of FTP.

The Risk Management System shall be in operation as under:-

(a) Computer System in DGFT HQ, on random

basis and on the basis of guidelines issued by DGFT from time to time, will

select 10% of cases for each RA which has issued scrips/ status holder

certificates in the preceding month by 10th of every month.

(b) The list of such selected cases will be

sent to concerned RA by NIC by 15th of the month.

(c) Concerned RA, will in turn, ask for the

original/ physical documents by 30th of the month for examination in detail.

(d) The applicant shall be under obligation

to submit the document asked for in the next 15 days.

(e) Concerned RA in turn will examine such

documents in next 15 days. In cases, there is any deficiency the

applicant

shall rectify it in next one month from the date of communication by RA. In

case of excess availment of rewards, the applicant shall refund the excess

claim with interest as prescribed in paragraph 3.19 of FTP.

(f) In case the applicant fails to submit the

req ui red original documents/ rectify the deficiencies / refund the excess claim as stipulated above or does not respond to any communication regarding

the Risk Management System within 15 days of receipt of such communication,

RA will initiate action as per FTDR Act and Rules.

3.18

Status Certificate

Policy

for Status Holders is given in Chapter 3 of FTP.

3.19

Application for grant of Status Certificate

(a)

Status Certificates issued under FTP 2009-14 to an IEC holder shall remain

valid till 30th September, 2015 or till the issuance of status certificate

to such IEC holder under FTP 2015-20, whichever is earlier.

(b) Applicants shall be required to file an

application online for recognition of status under the Policy in

ANF 3C. Scanned copy of relevant prescribed documents shall be uploaded by the

applicant unless prescribed otherwise.

(c) Online Application for status certificate

shall be filed using digital signature with jurisdictional RA / Development

Commissioner (DC) by Registered Office in the case of Company and by Head

Office in the case of others as indicated in table below:

| S.No |

Category |

Issuing /renewing Authority for

Status Certificate |

| 1. |

IEC holder having

exports of DTA unit as well as exports of SEZ/EOU unit. EHTP Electronic Hardware Technology Park/STP/BTP Biotechnology Park

|

Concerned Regional Authority as per

jurisdiction indicated in Appendix 1A |

| 2. |

IEC holder having SEZ/EOU

unit only |

Concerned Development Commissioner

as per jurisdiction indicated in

Appendix 1A |

| 3 |

IEC holder having DTA

unit only |

Concerned Regional Authority as per

jurisdiction indicated in Appendix 1A |

3.20

Validity of status certificate

(a)

Status Certificates issued under this FTP shall be valid for a period of 5

years from the date on which application for recognition was filed

14[or 31.03.2023, whichever is later] old[13[or 30.09.2022 only whichever is

later.]] old[12[or 30.06.2022,

whichever is later]] old[11[or 31.03.2022,

whichever is later]] old[9[or 30.09.2021, whichever is later]]

old[7[or 31.03.2021, whichever is later.]]

(b) Status Certificates valid beyond

31.3.2020 shall continue to remain in force, in case provisions of

subsequent Foreign Trade Policy continue to recognize the status.

3.21

Maintenance of Accounts

Status

Holders shall maintain true and proper accounts of its exports and import

based on which such recognition has been granted. Records shall be

maintained for a period of two years from the date of grant of status

certificate. These accounts shall be made available for inspection to RA

concerned or any Authority nominated by DGFT.

based on which such recognition has been granted. Records shall be

maintained for a period of two years from the date of grant of status

certificate. These accounts shall be made available for inspection to RA

concerned or any Authority nominated by DGFT.

3.22

Refusal /Suspension /Cancellation of Certificate

Status

Certificate may be refused / suspended/ cancelled by RA concerned, if status

holder or authorized representative acting on his behalf:

(a) Fails to discharge export obligation

imposed;

(b) Tampers with Authorisations;

(c) Misrepresents or has been a party to any

corrupt or fraudulent practice in obtaining any Authorisation;

(d) Commits a breach of FT (D& R) Act, or

Rules, Orders

made there under and FTP, The Customs Act 1962, The Central

Excise Act 1944, FEMA Act 1999 and COFEPOSA Act 1974; or

made there under and FTP, The Customs Act 1962, The Central

Excise Act 1944, FEMA Act 1999 and COFEPOSA Act 1974; or

(e) Fails to furnish information required by

this Directorate.

A reasonable opportunity shall be given to

Status Holder before taking any action under this paragraph.

3.23

Appeal

An

applicant, who is not satisfied with decision taken to suspend or cancel

Status Certificate, may file an appeal to DGFT within 45 days. Decision of

DGFT shall be final and binding thereon.

3[3.24 No Incentive Certificate under MEIS Merchandise Exports from India Scheme

a) Wherever an exporter requires a certificate to the effect that No

incentive under MEIS Merchandise Exports from India Scheme has been taken for shipment(s) which is being re-imported,

the exporter will submit a request in the specified format ,

ANF 3E-

"Application for No Incentive Certificate'' to the concerned Regional Authority

(RA) as per para 3.06 (a) of the HBP2015-20.

b) The following procedure will be followed at the concerned Regional Authority

while issuing the No Incentive Certificate, in the specified format Appendix 3F.

i. Wherever. MEIS Merchandise Exports from India Scheme has been utilized by the applicant for the

relevant shipping bill(s). the applicant is required to refund the proportionate

amount along with interest at the rate prescribed under the section 28AA

of the Customs Act, in the relevant Head of Account of Customs. On receipt of

proof of payment, the RA would issue the certificate.

ii. Wherever. MEIS Merchandise Exports from India Scheme has been issued to the applicant for the

relevant shipping bill (s) but the MEIS Merchandise Exports from India Scheme scrip has not been utilised, the

applicant should surrender the MEIS Merchandise Exports from India Scheme scrip to the RA.

The RA would then issue the

certificate and simultaneously inform the NIC to block the relevant shipping

bill(s).

iii. Wherever, MEIS Merchandise Exports from India Scheme has not been applied for or MEIS Merchandise Exports from India Scheme has been

applied for but no scrip has been issued, the RA would issue the certificate in

the specified format, on the basis of the undertaking submitted in

the application and simultaneously inform the NIC to block the relevant shipping

bill(s).]

Refer

vide Instruction No. 03/2019 -Customs dt.

13/08/2019

Refer Trade Notice No. 08/2018-19 Dated

15/05/2018

Refer Trade Notice No. 14/2018-19 Dated

30/05/2018

Refer Trade

Notice No. 46/2018-19 Dated 06/02/2019

Refer Trade

Notice No. 51/2018-19 Dated 29/03/2019

1.

Substituted Vide :

Public Notice No. 33/2015-2020, Dated

23/10/2017

2. Substituted

Vide :

Public Notice No. 67/2015-2020, Dated 22/03/2018

3. Inserted vide :

Public Notice No. 17/2015-2020, Dated 03/07/2018

4. Inserted vide :

Public Notice No. 84/2015-2020, Dated 03/04/2019

5. Substituted vide :

Public Notice No. 08/2015-2020, Dated 14/05/2019

6. Inserted vide :

Public Notice No. 58/2015-2020, Dated 29/01/2020

7. Inserted

Vide Public Notice 67/2015-2020

Dt.31.03.2020

8. Inserted

Vide Public Notice 08/2015-2020

Dt.01.06.2020

9. Substituted vide :

Public Notice No. 48/2015-2020, Dated 31/03/2021

10. Inserted

Vide: Public Notice 53/2015-2020

Dt.09.04.2021

11. Substituted vide :

Public Notice No. 25/2015-2020 Dated 28/09/2021

12. Substituted vide :

Public Notice No. 53/2015-2020 Dated 31/03/2022

13. Substituted vide :

Public Notice No. 21/2015-2020 Dated 05/08/2022

14. Substituted vide :

Public Notice No. 26/2015-2020, Dated 29/09/2022

bill of entry filed by importer in specified market,

or

bill of entry filed by importer in specified market,

or