foreign exchange. Supply

of goods as specified in Paragraph

below shall be regarded as “Deemed Exports” provided goods are

manufactured in India.

foreign exchange. Supply

of goods as specified in Paragraph

below shall be regarded as “Deemed Exports” provided goods are

manufactured in India.Foreign Trade Policy 2023

CHAPTER 7

Deemed Exports

(Relevant Procedure Chapter 7)

7.00 Objective

To provide a level-playing field to domestic manufacturers and to promote Make in India, in certain specified cases, as may be decided by the Government from time to time.

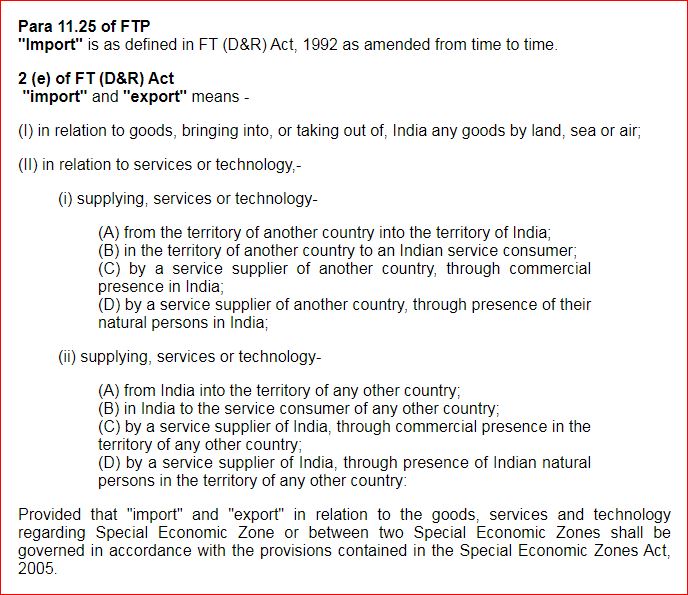

7.01 Deemed Exports

(i) “Deemed Exports” for the purpose of this FTP refer to those

transactions in which goods supplied do not leave country, and payment for such

supplies is received either in Indian rupees or in

free

foreign exchange. Supply

of goods as specified in Paragraph

below shall be regarded as “Deemed Exports” provided goods are

manufactured in India.

foreign exchange. Supply

of goods as specified in Paragraph

below shall be regarded as “Deemed Exports” provided goods are

manufactured in India.

(ii) “Deemed Exports” for the purpose of GST would include only the supplies notified under Section 147 of the CGST/SGST Act, on the recommendations of the GST Council. The benefits of GST and conditions applicable for such benefits would be as specified by the GST Council and as per relevant rules and notification.

7.02 Categories of Supply

Supply of goods under following categories (a) to (c) by a manufacturer and under categories (d) to (g) by main / sub-contractors shall be regarded as ‘Deemed Exports’:

A. Supply by manufacturer:

*(a) Supply of goods against Advance Authorisation / Advance Authorisation for annual requirement / DFIADuty Free Import Authorisation.

(b) Supply of goods to

EOU

/ STP /

EHTPElectronic Hardware

Technology Park /

BTPBiotechnology Park.

/ STP /

EHTPElectronic Hardware

Technology Park /

BTPBiotechnology Park.

(c) Supply of

capital goods

against EPCG Authorisation.

against EPCG Authorisation.

B. Supply by main / sub-contractor(s):

(d) (i) Supply of goods to projects financed by multilateral or bilateral Agencies / Funds as notified by Department of Economic Affairs (DEA), MoFMinistry of Finance, where legal agreements provide for tender evaluation without including customs duty.

(ii) Supply and installation of goods and equipment (single responsibility of turnkey contracts) to projects financed by multilateral or bilateral Agencies/Funds as notified by Department of Economic Affairs (DEA), MoF, for which bids have been invited and evaluated on the basis of Delivered Duty Paid (DDP) prices for goods manufactured abroad.

(iii) Supplies covered in this paragraph shall be under International Competitive Bidding (ICB) in accordance with procedures of those Agencies / Funds.

(iv) A list of agencies, covered under this paragraph, for deemed export benefits, is given in Appendix- 7A.

(e) (i) Supply of goods to any project or for any purpose in respect of

which the Ministry of Finance by Customs Notification No. 50/2017-Customs dated

30.6.2017, as amended from time to time, permits

import

of such goods at zero

basic customs duty subject to conditions mentioned therein. Benefits of

deemed export

of such goods at zero

basic customs duty subject to conditions mentioned therein. Benefits of

deemed export

shall be available only if the supply is made under procedure of ICB.

shall be available only if the supply is made under procedure of ICB.

(i) Supply of goods required for setting up of any mega power project, as specified

in the list 31 at Sl. No. 598 of Department of Revenue Notification No. 50/2017-Customs dated 30.6.2017, as amended from time to time and subject to conditions mentioned therein, shall be eligible for deemed export benefits provided such mega power project conforms to the threshold generation capacity specified in the above said Notification.

(ii) For mega power projects, ICB condition would not be mandatory if the requisite quantum of power has been tied up through tariff based competitive bidding or if the project has been awarded through tariff based competitive bidding.

(f) Supply of goods to United Nations or International organization for their official use or supplied to the projects financed by the said United Nations or an International organization approved by Government of India in pursuance of Section 3 of United Nations (Privileges and Immunities Act), 1947. List of such organization and conditions applicable to such supplies is given in the Customs Notification No. 84/97-Customs dated 11.11.1997, as amended from time to time. A list of Agencies, covered under this paragraph, is given in Appendix-7B.

(g) Supply of goods to nuclear power projects provided:

i) Such goods are required for setting up of any Nuclear Power Project as specified in the list 32 at Sl. No. 602, Customs notification No. 50/2017- Customs dated 30.6.2017, as amended from time to time and subject to conditions mentioned therein.

ii) The project should have a capacity of 440 MW or more.

iii) A certificate to the effect is required to be issued by an officer not below the rank of Joint Secretary to Government of India, in Department of Atomic Energy.

iv) Tender is invited through National competitive bidding (NCB) or through ICBInternational Competitive Bidding.

7.03 Benefits for Deemed Exports

Deemed export

shall be eligible for any / all of following benefits in

respect of manufacture

shall be eligible for any / all of following benefits in

respect of manufacture

and supply of goods, qualifying as deemed exports,

subject to terms and conditions as given in HBP and

ANF-7A:

and supply of goods, qualifying as deemed exports,

subject to terms and conditions as given in HBP and

ANF-7A:

(a) Advance Authorisation / Advance Authorisation for annual requirement / DFIA Duty Free Import Authorisation.

(b) Deemed Export Drawback.

(c) Refund of terminal excise duty for excisable goods mentioned in Schedule 4 of Central Excise Act, 1944 provided the supply is eligible under that category of deemed exports and there is no exemption.

7.04 Benefits to the Supplier /Recipient

|

Categories of supplies as per Para 7.02 |

Benefits on supplies, as given in Para 7.03 above, whichever is applicable. |

||

|

Para 7.03 (a) Advance Authorisation |

Para 7.03 (b) Duty Drawback |

Para 7.03 (c) Terminal Excise Duty |

|

|

(a) |

Yes (for intermediate supplies against an invalidation letter) |

Yes (against AROAdvance Release Order) |

Yes |

|

(b) |

Yes |

Yes |

Yes |

|

(c) |

Yes |

Yes |

NA |

|

(d) |

Yes |

Yes |

NA |

|

(e) |

Yes |

Yes |

NA |

|

(f) |

Yes |

Yes |

NA |

|

(g) |

Yes |

Yes |

NA |

7.05 Conditions for refund of Terminal Excise Duty

Supply of goods will be eligible for refund of terminal excise duty as per Para 7.03 (c) of FTP, provided recipient of goods does not avail CENVAT credit/rebate on such goods.

7.06 Conditions for refund of Deemed Export drawback

Supplies will be eligible for

deemed export

drawback as per para 7.03 (b)

of FTP, as under:

drawback as per para 7.03 (b)

of FTP, as under:

Refund of drawback on the inputs used in manufacture and supply under the said category can be claimed on ‘All Industry Rate’ of Duty Drawback Schedule notified by Department of Revenue from time to time provided no CENVAT credit has been availed by supplier of goods on excisable inputs or on ‘Brand Rate Basis’ upon submission of documents evidencing actual payment of basic custom duties.

7.07 Common conditions for deemed export benefits

(i) Supplies shall be made directly to entities listed in the Para 7.02. Third party supply shall not be eligible for benefits/exemption.

(ii) In all cases, supplies shall be made directly to the designated Projects / Agencies/ Units/ Advance Authorisation/ EPCG Authorisation holder. Sub- contractors may, however, make supplies to main contractor instead of supplying directly to designated Projects/ Agencies. Payments in such cases shall be made to sub-contractor by main-contractor and not by project Authority.

(iii) Supply of domestically manufactured goods by an Indian Subcontractor

to any Indian or foreign main contractor, directly at the designated project’s/

Agency’s site, shall also be eligible for deemed

export

benefit provided name of

sub- contractor is indicated either originally or subsequently (but before the

date of supply of such goods) in the main contract. In such cases payment shall

be made directly to sub-contractor by the Project Authority.

benefit provided name of

sub- contractor is indicated either originally or subsequently (but before the

date of supply of such goods) in the main contract. In such cases payment shall

be made directly to sub-contractor by the Project Authority.

(iv) Steel manufacturers supplying steel against Advance Authorization under Para 7.02 (a), through their Service Centers/ Distributors/ Dealers/ Stock yards,shall also be eligible to claim duty drawback provided such supplies are made in accordance with Ministry of Steel O.M. No. S-21016/3/2020-TRADE-TAX- Part(1) dated 27.5.2020 read with O.M. dated 24.6.2020, as amended from time to time. However, the invoice against such supplies would be raised by the manufacturer on the Advance Authorization holder. Delivery of such supplies can be made through their Service Centers/ Distributors/ Dealers/ Stock yards, who in turn will raise the tax invoice on the steel manufacturer bearing a cross reference for such supplies.

7.08

Benefits on

specified

supplies

supplies

(i)

deemed export

benefits shall be available for supplies of “Cement”

under Para 7.02(d) only.

benefits shall be available for supplies of “Cement”

under Para 7.02(d) only.

(ii) Deemed export benefit shall be available on supply of “Steel”:

(a) As an inputs to Advance Authorisation/ Annual Advance Authorisation/DFIADuty Free Import Authorisation holder/ an EOU

.

(b) To multilateral/ bilateral funded Agencies as per sub-para 7.02(d).

(iii) Deemed export benefit shall be available on supply of “Fuel” (in respect of eligible fuel items covered under Schedule 4 of Central Excise Act, 1944) provided supplies are made to:

(a) EOUs.

(b) Advance Authorisation holder / Annual Advance Authorisation holder.

7.09 Liability of Interest

Incomplete/deficient application is liable to be rejected. However, simple interest @ 6% per annum will be payable on delay in refund of duty drawback and terminal excise duty under the scheme, provided the claim is not settled within 30 days from the date of issue of final Approval Letter by RA Regional Authority.

7.10 Risk Management and Internal Audit mechanism

(a) A Risk Management system shall be in operation, wherein every month, Computer system in DGFT headquarters, on random basis, will select 10% of cases, for each RA, where benefit(s) under this Chapter has/have already been granted. Such cases shall be scrutinized by an internal Audit team, headed by a Joint DGFT, in the office of respective Zonal Addl. DGFT. The team will be responsible to audit claims of not only for its own office but also the claims of all RAs falling under the jurisdiction of the Zone.

(b) The respective RA may also, either on the basis of report from Internal Audit/ External Audit Agency(ies) or suo-motu, re-assess any case, where any erroneous/ in-eligible payment has been made/claimed. RA will take necessary action for recovery of payment along with interest at the rate of 15% per annum on the recoverable amount.

7.11 Penal Action

In case, claim is filed by submitting mis-declaration/ mis-representation

of facts, then in addition to effecting recovery under Para 7.10(b) above, the

applicant

shall be liable for penal action under the provisions of FT(D&R) Act,

Rules and

orders

shall be liable for penal action under the provisions of FT(D&R) Act,

Rules and

orders made there under.

made there under.