Essential Updates: Post-Supply Discounts & ITC Reversal

Overview of Section 15(3)

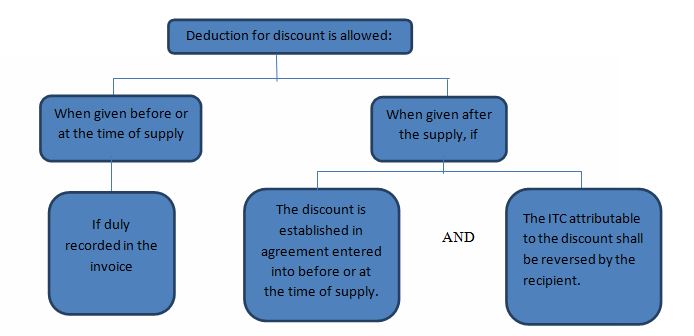

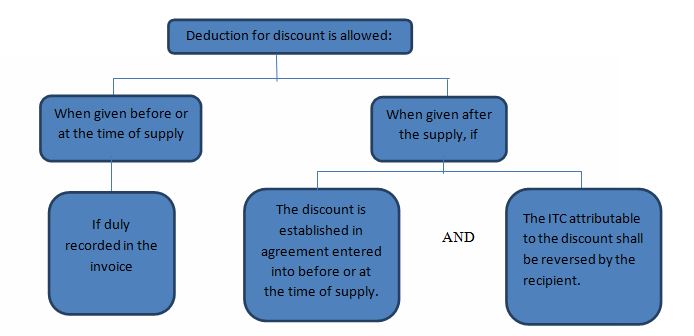

Section 15(3) of the CGST Act 2017 specifies how discounts impact the value of supply under GST which is summarized as follows:

Under the GST regime, 'discounts' are excluded from the value of supply as per Section 15(3) of the CGST Act 2017, wherein Section 15(3)(b) specifically covers discounts provided 'after the supply has been effected' i.e. post-sale discounts, subject to fulfilment of the following conditions:

(i) The terms of discount are agreed by means of an agreement before or at the time of supply, and is specifically linked to relevant invoices, and

(ii) ITC attributable to discount is reversed by the recipient of supply based on the credit note issued by the supplier for extending such discount.

Circular Clarifications

The Central Board of Indirect Taxes and Customs (Board) issued two circulars to clarify the treatment of post-supply discounts:

1. Circular No. 92/11/2019-GST dated 07.03.2019 provided clarification on treatment of sales promotion schemes including a secondary discount which is summarized below:

Secondary discounts are given after the supply has been made or if the amount was not known at the time of supply. For example, if a supplier revises the price and issues a credit note after the sale, this constitutes a secondary discount.

It was clarified that financial /commercial credit notes can be issued for secondary discounts if the conditions under Section 15(3)(b) are not met.

These secondary discounts do not need to be excluded from the supply value because they were not known at the time of supply and do not meet the conditions outlined in Section 15(3)(b).

Thus, the value of supply would not be reduced by the discount if it is :

Given by the seller through the method of the financial/commercial credit notes.

If the specific conditions in Section 15(3)(b) are not satisfied.

Importantly, issuing these discounts does not affect the supplier's ability to claim Input Tax Credit (ITC).

Example: X buys goods worth Rs. 1,00,000 plus Rs. 18,000 GST from Y (Seller) for FY 2021-22 and pays Y a total of Rs. 1,18,000. Y then files their GSTR-1, allowing X to claim an ITC of Rs. 18,000. In FY 2022-23, Y offers a volume discount to X for the previous year's purchases that does not meet the criteria under Section 15(3)(b). In this case, Y may issue financial or commercial credit notes for the discount without applying GST, as the discount does not alter the original supply value. Consequently, X does not need to reverse the ITC claimed on these credit notes.

2. Circular No. 105/24/2019-GST (28.06.2019)

This circular was issued in pursuant to the above circular that had clarified that post-sale discount given by the supplier without any further obligation/action required at the dealer's end will not be includible in the value of supply. However, if such dealer is required to undertake certain actions like advertisement drives, special sales drive etc, this would constitute a separate supply wherein the discount provided will take the form of 'consideration' on which GST is leviable.

This circular was later rescinded by Circular No. 112/31/2019-GST dated 03.10.2019 based on recommendations from the 37th GST Council Meeting.

Latest Developments

Following the 53rd GST Council Meeting, the Central Board of Indirect Taxes and Customs issued Circular No. 212/6/2024-GST on 26.06.2024 to address verification issues for ITC reversals related to discounts under Section 15(3)(b)(ii) of the CGST Act, 2017. This circular responds to the lack of portal functionality for verifying ITC reversals and aims to clarify compliance requirements to reduce litigation.

Key updates:

Interim ITC Reversal Verification Solution: Until the common portal allows for ITC reversal verification, suppliers can obtain a certificate from a Chartered Accountant (CA) or Cost Accountant (CMA). This certificate must confirm that the recipient has proportionately reversed the ITC related to the credit note issued by the supplier.

CA/CMA Certificate: The CA/CMA certificate should include details such as the credit notes, the relevant invoice numbers against which the credit notes were issued, the amount of ITC reversal for each credit note, and the details of FORM GST DRC-03, return, or any other relevant document through which the recipient has made the ITC reversal. Such certificate issued by a CA or CMA must contain a Unique Document Identification Number (‘UDIN’).

Simplified Compliance for Small discounts: In cases where the total tax amount (CGST, State GST, Integrated GST, including compensation cess, if any) involved in the discount given by the supplier through tax credit notes in a financial year does not exceed Rs. 5,00,000, the suppliers can obtain an undertaking or certificate from the recipient confirming ITC reversal.

Admissibility of Certificates and Undertakings: Certificates from Chartered Accountants (CA) or Cost Accountants (CMA), as well as undertakings from recipients, are considered valid evidence for compliance with Section 15(3)(b)(ii) of the CGST Act. Suppliers must present these documents during audits, scrutiny, or investigations. For previous periods, such certificates or undertakings can be used to demonstrate ITC reversal related to post-sale discounts.

Conclusion

The recent updates on discounts under GST, guided by Section 15(3) of the CGST Act, aim to clarify and streamline the treatment of post-supply discounts. The introduction of interim verification measures, including CA/CMA certificates and simplified compliance for smaller amounts, addresses existing challenges and enhances transparency. These changes are expected to reduce disputes and ensure more consistent application of GST rules. However, the reliance on certificates and undertakings until a portal functionality is established may still pose administrative burdens on taxpayers and professionals. The long-term resolution will hinge on developing and deploying robust system functionalities to streamline these processes further.

Disclaimer: The information given in this article is solely for purpose of understanding the law. It is completely based on the interpretation of the author and cannot be constituted as a legal advise, the author of this article and Lawcrux team is not responsible for any legal issues if arises on the basis of the interpretation given above.