to an applicant on matters or on

questions specified in sub-section (2) of section 97 or sub-section (1) of

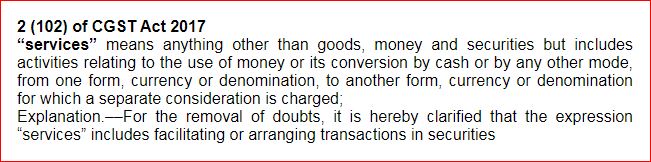

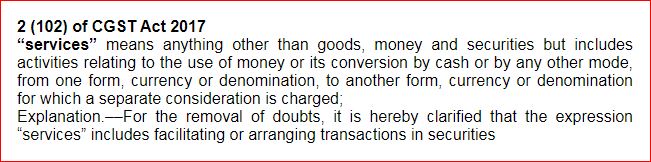

section 100, in relation to the supply of goods or

services

to an applicant on matters or on

questions specified in sub-section (2) of section 97 or sub-section (1) of

section 100, in relation to the supply of goods or

services

or both being

undertaken or proposed to be undertaken by the applicant;

or both being

undertaken or proposed to be undertaken by the applicant;

THE CENTRAL GOODS AND SERVICES TAX ACT, 2017

ADVANCE RULING

Section 95: Definitions. (Relevant Updates)

In this Chapter, unless the context otherwise requires,––

a) “advance ruling” means a decision provided by

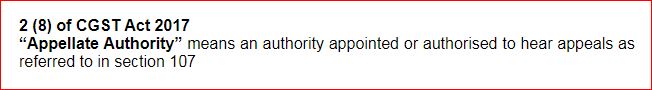

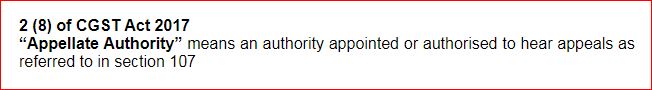

the Authority or the Appellate Authority

to an applicant on matters or on

questions specified in sub-section (2) of section 97 or sub-section (1) of

section 100, in relation to the supply of goods or

services

to an applicant on matters or on

questions specified in sub-section (2) of section 97 or sub-section (1) of

section 100, in relation to the supply of goods or

services

or both being

undertaken or proposed to be undertaken by the applicant;

or both being

undertaken or proposed to be undertaken by the applicant;

b) “Appellate Authority” means the Appellate Authority for Advance Ruling referred to in section 99.

*c) “applicant”

means any person registered or desirous of obtaining registration under this

Act;

d) “application” means

an application made to the Authority under sub-section (1) of

section 97;

e) “Authority” means the

Authority for Advance Ruling referred to in section 96 ;