THE CENTRAL GOODS AND SERVICES TAX ACT, 2017

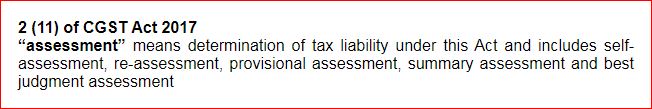

ASSESSMENT

Section 64:

Summary assessment in certain

special cases.

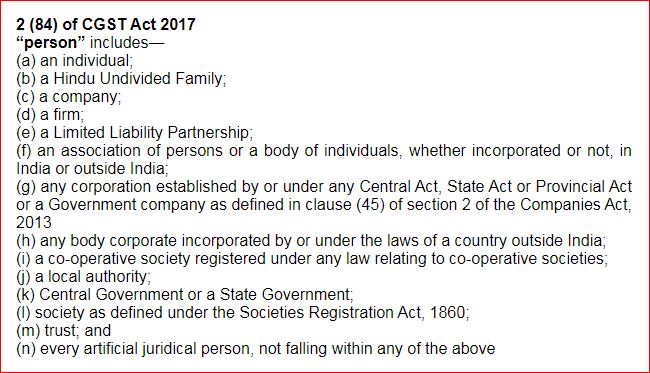

(1) The proper officer may, on any

evidence showing a tax liability of

a

person

coming to his notice, with the previous permission of Additional

Commissioner or Joint Commissioner, proceed to assess the tax liability of such

person to protect the interest of revenue and issue an

assessment

coming to his notice, with the previous permission of Additional

Commissioner or Joint Commissioner, proceed to assess the tax liability of such

person to protect the interest of revenue and issue an

assessment

order, if he

has sufficient grounds to believe that any delay in doing so may adversely

affect the interest of revenue:

order, if he

has sufficient grounds to believe that any delay in doing so may adversely

affect the interest of revenue:

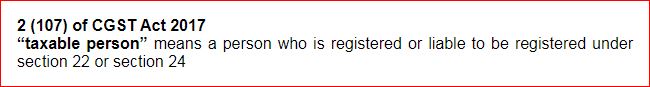

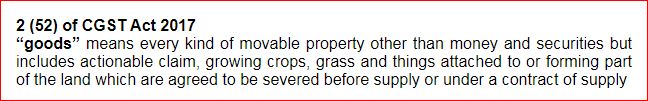

Provided

that where the

taxable person

to whom the liability pertains is not

ascertainable and such liability pertains to supply of goods, the person in

charge of such

goods

to whom the liability pertains is not

ascertainable and such liability pertains to supply of goods, the person in

charge of such

goods

shall be deemed to be the taxable person liable to be

assessed and liable to pay tax and any other amount due under this section.

shall be deemed to be the taxable person liable to be

assessed and liable to pay tax and any other amount due under this section.

(2) On an application made by the taxable person within thirty days from the

date of receipt of order passed under sub-section (1) or on his own motion, if

the Additional Commissioner or Joint Commissioner considers that such order is

erroneous, he may withdraw such order and follow the procedure laid down in

section 73 or

section 74

1[or section 74A].