THE CENTRAL GOODS AND SERVICES TAX ACT, 2017

ACCOUNTS AND RECORDS

Section 36: Period of retention of accounts. (Relevant Updates)

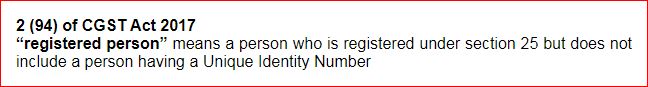

Every

registered person

required to keep and maintain books of account or other records in

accordance with the provisions of sub-section (1) of

section 35 shall retain

them until the expiry of seventy two months from the due date of furnishing of

annual return for the year pertaining to such accounts and records:

required to keep and maintain books of account or other records in

accordance with the provisions of sub-section (1) of

section 35 shall retain

them until the expiry of seventy two months from the due date of furnishing of

annual return for the year pertaining to such accounts and records:

Provided that a registered person, who

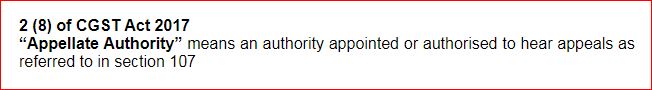

is a party to an appeal or revision or any other proceedings before any

Appellate Authority

or

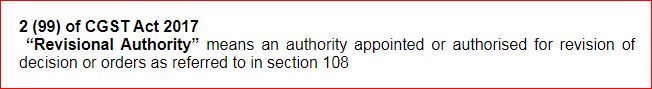

Revisional Authority

or

Revisional Authority

or

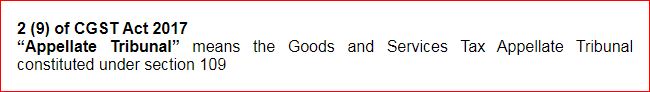

Appellate Tribunal

or

Appellate Tribunal

or court,

whether filed by him or by the

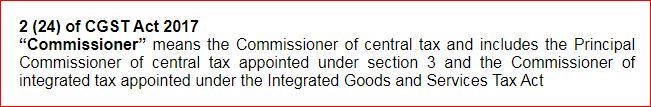

Commissioner

or court,

whether filed by him or by the

Commissioner

, or is under investigation for an

offence under Chapter XIX, shall retain the books of account and other records

pertaining to the subject matter of such appeal or revision or proceedings or

investigation for a period of one year after final disposal of such appeal or

revision or proceedings or investigation, or for the period specified above,

whichever is later.

, or is under investigation for an

offence under Chapter XIX, shall retain the books of account and other records

pertaining to the subject matter of such appeal or revision or proceedings or

investigation for a period of one year after final disposal of such appeal or

revision or proceedings or investigation, or for the period specified above,

whichever is later.