Rate of duty

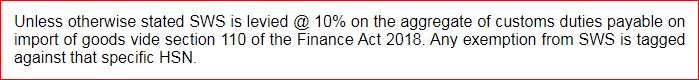

SWS : 10%

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 9%

Norway: 9%

Iceland: 9%

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 9%

Iceland: 9%

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 9%

Iceland: 9%

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 9%

Iceland: 9%

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 9%

Iceland: 9%

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 9%

Iceland: 9%

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8.57%

Iceland: 8.57%

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8.57%

Iceland: 8.57%

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8.57%

Iceland: 8.57%

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8.57%

Iceland: 8.57%

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 9%

Norway: 9%

Iceland: 9%

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 9%

Norway: 9%

Iceland: 9%

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 9%

Norway: 9%

Iceland: 9%

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 9%

Iceland: 9%

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 9%

Iceland: 9%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil/1%/3%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil/1%/3%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil/1%/3%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil/1%/3%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil/1%/3%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil/1%/3%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil/1%/3%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil/1%/3%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: 15%

SWS: NIL

SAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil

SWS

:

NIL

:

NILJapan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: 50%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NILJapan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: 50%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: 1%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: 1%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: 1%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: 1%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: 1%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: 1%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: 1%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: 1%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: 1%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: 1%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: 3%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: 3%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: 3%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: 3%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NIL[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/15%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/15%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/15%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/15%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/15%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/15%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/15%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/15%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/15%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/15%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/15%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/15%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/15%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/15%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/15%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/15%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/15%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/15%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/15%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/15%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[125%]helldod]

BCD: 15%/35%/70%2

IGST: 5%/18%/40%

CESS: Nil/17%/20%/22%

SWS

:

NIL

:

NILSAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil

SWS: NIL

UAE: 10.5%/17.5%/20%Nil

Malaysia: Nil / Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil

SWS: NIL

UAE: 10.5%/17.5%/20%Nil

Malaysia: Nil / Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil

SWS: NIL

UAE: 10.5%/17.5%/20%Nil

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil

SWS: NIL

UAE: 10.5%/17.5%/20%Nil

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil

SWS: NIL

UAE: 10.5%/17.5%/20%Nil

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil

SWS: NIL

UAE: 10.5%/17.5%/20%Nil

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil

SWS: NIL

UAE: 10.5%/17.5%/20%Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil

SWS: NIL

UAE: 10.5%/17.5%/20%Nil

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil

SWS: NIL

UAE: 10.5%/17.5%/20%Nil

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil

SWS: NIL

UAE: 10.5%/17.5%/20%Nil

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil

SWS: NIL

UAE: 10.5%/17.5%/20%Nil

SAFTA: 5%

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil

SWS: NIL

UAE: 10.5%/17.5%/20%Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil

SWS: NIL

UAE: 10.5%/17.5%/20%Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil

SWS: NIL

UAE: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil

SWS: NIL

UAE: 10.5%/17.5%/20%Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil

SWS: NIL

UAE: 10.5%/17.5%/20%Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

[helldodold[40%]helldod]

BCD: Nil/15%/20%

IGST: 5%/18%

CESS: Nil

SWS: NIL

UAE: 10.5%/17.5%/20%Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

IGST: 5%/18%

CESS: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8.57%

Iceland: 8.57%

IGST: 5%/18%

CESS: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8.57%

Iceland: 8.57%

IGST: 5%/18%

CESS: Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

IGST: 5%/18%

CESS: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8.57%

Iceland: 8.57%

IGST: 5%/18%

CESS: Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

IGST: 5%/18%

CESS: Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

IGST: 5%/18%

CESS: Nil

SAFTA: 5%

IGST: 5%/18%

CESS: Nil

Japan: Nil

SAFTA: 5%

Switzerland: 13.50%

Norway: 12.86%

Iceland: 13.50%

IGST: 5%/18%

CESS: Nil

SAFTA: 5%

IGST: 5%/18%

CESS: Nil

SAFTA: 5%

IGST: 5%/18%

CESS: Nil

SAFTA: 5%

Switzerland: 13.50%

Norway: 13.50%

Iceland: 13.50%

IGST: 5%/18%

CESS: Nil

SAFTA: 5%

IGST: 5%/18%

CESS: Nil

SAFTA: 5%

Switzerland: 13.50%

Norway: 13.50%

Iceland: 13.50%

IGST: 5%/18%

CESS: Nil

SAFTA: 5%

IGST: 5%/18%

CESS: Nil

SAFTA: 5%

IGST: 5%/18%

CESS: Nil

SAFTA: 5%

IGST: 5%/18%

CESS: Nil

SAFTA: 5%

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: 5%

Singapore : Nil / Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 13.50%

Norway: 13.50%

Iceland: 13.50%

IGST: 5%/18%

CESS: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil / Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

IGST: 5%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

Singapore: Nil / Nil

SAFTA: 5%

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 9%

Norway: 9%

Iceland: 9%

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

Singapore: Nil / Nil

SAFTA: 5%

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 13.50%

Norway: 13.50%

Iceland: 13.50%

IGST: 5%/18%

CESS: Nil

SAFTA: 5%

Switzerland: 13.50%

Norway: 13.50%

Iceland: 13.50%

IGST: 5%/18%

CESS: Nil

SAFTA: 5%

Switzerland: 13.50%

Norway: 13.50%

Iceland: 13.50%

IGST: 5%/18%

CESS: Nil

SAFTA: 5%

IGST: 5%

CESS: Nil

SAFTA: 5%

Switzerland: 13.50%

Norway: 13.50%

Iceland: 13.50%

IGST: 5%

CESS: Nil

Japan: 6.25%

Malaysia: Nil / Nil

Singapore: Nil / Nil

SAFTA: 5%

Korea: 6.25%

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 13.50%

Norway: 13.50%

Iceland: 13.50%

IGST: 5%

CESS: Nil

Malaysia: Nil/5% / Nil/5%

SAFTA: 5%

Singapore : Nil/5%

Thailand : Nil/5%

Vietnam : Nil/5%

Myanmar : Nil/5%

Indonesia : Nil/5%

Brunei Darussalam : Nil/5%

Lao People's Democratic Republic : Nil/5%

Cambodia : Nil/5%

Philippines : Nil/5%

Switzerland: 13.50%

Norway: 13.50%

Iceland: 13.50%

IGST: 5%

CESS: Nil

ADD:

N/N

07/2024

|

upto 14.03.2029 |

N/N

09/2023

|

upto 10.09.2028 |

N/N

17/2019

|

upto 08.04.2024 |

N/N

46/2018

|

upto 12.09.2023 |

Japan: Nil

Malaysia: 5% / 5%

Singapore: 5% / 5%

SAFTA: 5%

Korea: 6.25%

Thailand : 5%

Vietnam : 5%

Myanmar : 5%

Indonesia : 5%

Brunei Darussalam : 5%

Lao People's Democratic Republic : 5%

Cambodia : 5%

Philippines : 5%

Switzerland: 13.50%

Norway: 13.50%

Iceland: 13.50%

IGST: 5%/18%

CESS: Nil

Malaysia: 5% / 5%

SAFTA: 5%

Singapore: 5%

Thailand : 5%

Vietnam : 5%

Myanmar : 5%

Indonesia : 5%

Brunei Darussalam : 5%

Lao People's Democratic Republic : 5%

Cambodia : 5%

Philippines : 5%

Switzerland: 13.50%

Norway: 13.50%

Iceland: 13.50%

IGST: 5%

CESS: Nil

Singapore: Nil / Nil

SAFTA: 5%

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 13.50%

Norway: 13.50%

Iceland: 13.50%

IGST: 5%

CESS: Nil

Japan: Nil

Malaysia: 5% / 5%

SAFTA: 5%

Singapore: 5%

Thailand : 5%

Vietnam : 5%

Myanmar : 5%

Indonesia : 5%

Brunei Darussalam : 5%

Lao People's Democratic Republic : 5%

Cambodia : 5%

Philippines : 5%

Switzerland: 13.50%

Norway: 13.50%

Iceland: 13.50%

IGST: 5%

CESS: Nil

SAFTA: 5%

Switzerland: 13.50%

Norway: 13.50%

Iceland: 13.50%

IGST: 5%

CESS: Nil

ADD:

N/N

04/2021

|

upto 29.01.2026 |

Malaysia: 5% / 5%

SAFTA: 5%

Singapore: 5%

Thailand : 5%

Vietnam : 5%

Myanmar : 5%

Indonesia : 5%

Brunei Darussalam : 5%

Lao People's Democratic Republic : 5%

Cambodia : 5%

Philippines : 5%

Switzerland: 13.50%

Norway: 13.50%

Iceland: 13.50%

IGST: 5%/18%

CESS: Nil

Malaysia: 5% / 5%

SAFTA: 5%

Singapore: 5%

Thailand : 5%

Vietnam : 5%

Myanmar : 5%

Indonesia : 5%

Brunei Darussalam : 5%

Lao People's Democratic Republic : 5%

Cambodia : 5%

Philippines : 5%

Switzerland: 13.50%

Norway: 13.50%

Iceland: 13.50%

IGST: 5%

CESS: Nil

ADD:

N/N

04/2021

|

upto 29.01.2026 |

Singapore: 5% / 5%

SAFTA: 5%

Korea: 5%

Thailand : 5%

Vietnam : 5%

Myanmar : 5%

Indonesia : 5%

Brunei Darussalam : 5%

Lao People's Democratic Republic : 5%

Cambodia : 5%

Philippines : 5%

IGST: 5%/18%

CESS: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8.57%

Iceland: 8.57%

IGST: 5%/18%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 9%

Norway: 9%

Iceland: 9%

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: 5% / 5%

SAFTA: 5%

Singapore : 5%

Thailand : 5%

Vietnam : 5%

Myanmar : 5%

Indonesia : 5%

Brunei Darussalam : 5%

Lao People's Democratic Republic : 5%

Cambodia : 5%

Philippines : 5%

Switzerland: 9%

Norway: 9%

Iceland: 9%

IGST: 5%

CESS: Nil

UAE: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: Nil

Norway: Nil

Iceland: Nil

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

UAE: Nil

Malaysia: 5% / 5%

SAFTA: 5%

Singapore : 5%

Thailand : 5%

Vietnam : 5%

Myanmar : 5%

Indonesia : 5%

Brunei Darussalam : 5%

Lao People's Democratic Republic : 5%

Cambodia : 5%

Philippines : 5%

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

UAE: Nil

Malaysia: 5% / 5%

SAFTA: 5%

Singapore : 5%

Thailand : 5%

Vietnam : 5%

Myanmar : 5%

Indonesia : 5%

Brunei Darussalam : 5%

Lao People's Democratic Republic : 5%

Cambodia : 5%

Philippines : 5%

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

UAE: Nil

Malaysia: 5% / 5%

SAFTA: 5%

Singapore : 5%

Thailand : 5%

Vietnam : 5%

Myanmar : 5%

Indonesia : 5%

Brunei Darussalam : 5%

Lao People's Democratic Republic : 5%

Cambodia : 5%

Philippines : 5%

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

SAFTA: 5%

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

SAFTA: 5%

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

SAFTA: 5%

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

SAFTA: 5%

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

SAFTA: 5%

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

SAFTA: 5%

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

SAFTA: 5%

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

SAFTA: 5%

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

UAE: 10.5%/17.5%/35%

Malaysia: 5% / 5%

SAFTA: 5%

Singapore : 5%

Thailand : 5%

Vietnam : 5%

Myanmar : 5%

Indonesia : 5%

Brunei Darussalam : 5%

Lao People's Democratic Republic : 5%

Cambodia : 5%

Philippines : 5%

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

UAE: 10.5%/17.5%/35%

Malaysia: 5% / 5%

SAFTA: 5%

Singapore : 5%

Thailand : 5%

Vietnam : 5%

Myanmar : 5%

Indonesia : 5%

Brunei Darussalam : 5%

Lao People's Democratic Republic : 5%

Cambodia : 5%

Philippines : 5%

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

UAE: 10.5%/17.5%/35%

Malaysia: 5% / 5%

SAFTA: 5%

Singapore : 5%

Thailand : 5%

Vietnam : 5%

Myanmar : 5%

Indonesia : 5%

Brunei Darussalam : 5%

Lao People's Democratic Republic : 5%

Cambodia : 5%

Philippines : 5%

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

UAE: 10.5%/17.5%/35%

SAFTA: 5%

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

UAE: 10.5%/17.5%/35%

SAFTA: 5%

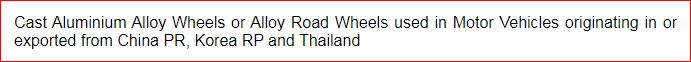

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

UAE: 10.5%/17.5%/35%

Malaysia: Nil / Nil

SAFTA: 5%

Korea: 50%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

UAE: 10.5%/17.5%/35%

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: 50%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

UAE: 10.5%/17.5%/35%

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: 50%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

UAE: 10.5%/17.5%/35%

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: 50%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

UAE: 10.5%/17.5%/35%

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: 50%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

UAE: 10.5%/17.5%/35%

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: 50%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

UAE: 10.5%/17.5%/35%

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: 50%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

[helldodold[100%]helldod]

BCD: 10%/15%/20%/25%/30%/40%/50%

IGST: 5%/18%/40%

CESS: 3%

UAE: 10.5%/17.5%/35%

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: 50%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

[helldodold[35%]helldod]

BCD: Nil1,2 / 18%

IGST: 5%

CESS: Nil

SWS: NIL

UAE: 20%

Malaysia: 5% / 5%

SAFTA: 5%

Singapore : 5%

Thailand : 5%

Vietnam : 5%

Myanmar : 5%

Indonesia : 5%

Brunei Darussalam : 5%

Lao People's Democratic Republic : 5%

Cambodia : 5%

Philippines : 5%

IGST: 5%

CESS: Nil

Malaysia: 5% / 5%

SAFTA: 5%

Singapore : 5%

Thailand : 5%

Vietnam : 5%

Myanmar : 5%

Indonesia : 5%

Brunei Darussalam : 5%

Lao People's Democratic Republic : 5%

Cambodia : 5%

Philippines : 5%

Switzerland: 8.57%

Norway: 8%

Iceland: Nil

IGST: 5%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8%

Iceland: Nil

IGST: 5%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8%

Iceland: Nil

IGST: 5%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore: Nil / Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8%

Iceland: Nil

IGST: 5%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore: Nil / Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8%

Iceland: Nil

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Singapore: Nil / Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 12.86%

Norway: 12%

Iceland: Nil

IGST: 5%/18%

CESS: Nil

SAFTA: 5%

Switzerland: 12.86%

Norway: 13.50%

Iceland: Nil

IGST: 5%/18%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8%

Iceland: Nil

IGST: 5%/18%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8%

Iceland: Nil

IGST: 5%/18%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8%

Iceland: Nil

IGST: 5%/18%

CESS: Nil

UAE: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 17.14%

Norway: 16%

Iceland: 17.14%

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 18%

Norway: 18%

Iceland: Nil

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 18%

Norway: 18%

Iceland: Nil

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 18%

Norway: 18%

Iceland: Nil

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 18%

Norway: 18%

Iceland: Nil

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 18%

Norway: 16%

Iceland: 17.14%

IGST: 5%/18%

CESS: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 18%

Norway: 18%

Iceland: Nil

IGST: 5%/18%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: Nil

Norway: Nil

Iceland: Nil

IGST: 5%/18%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 17.14%

Norway: 16%

Iceland: Nil

IGST: 5%/18%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 17.14%

Norway: 16%

Iceland: Nil

IGST: 5%/18%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 17.14%

Norway: 16%

Iceland: Nil

IGST: 5%/18%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 17.14%

Norway: 16%

Iceland: Nil

IGST: 5%/18%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 17.14%

Norway: 16%

Iceland: Nil

IGST: 5%/18%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 17.14%

Norway: 16%

Iceland: 17.14%

IGST: 5%/18%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore: Nil / Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8%

Iceland: Nil

IGST: 5%/18%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore: Nil / Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8%

Iceland: Nil

IGST: 5%/18%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Republic of Korea: 8.5%

Bangladesh: 8.5%

People’s Republic of China: 8.5%

Sri Lanka: 8.5%

Switzerland: 8.57%

Norway: 8.57%

Iceland: 8.57%

IGST: 5%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Republic of Korea: 5.5%

Bangladesh: 5.5%

People’s Republic of China: 5.5%

Sri Lanka: 5.5%

Switzerland: 8.57%

Norway: 8.57%

Iceland: 8.57%

IGST: 5%/18%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 9%

Norway: 9%

Iceland: 9%

IGST: 5%/18%

CESS: Nil

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Singapore : Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8.57%

Iceland: 8.57%

IGST: 5%/18%

CESS: Nil

UAE: 4.5%

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8.57%

Iceland: 8.57%

IGST: 5%/18%

CESS: Nil

UAE: 4.5%

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8.57%

Iceland: 8.57%

IGST: 5%/18%

CESS: Nil

UAE: 4.5%

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8.57%

Iceland: 8.57%

IGST: 5%/18%

CESS: Nil

UAE: 4.5%

Australia: Nil

Japan: Nil

Malaysia: Nil / Nil

SAFTA: 5%

Korea: Nil

Thailand : Nil

Vietnam : Nil

Myanmar : Nil

Indonesia : Nil

Brunei Darussalam : Nil

Lao People's Democratic Republic : Nil

Cambodia : Nil

Philippines : Nil

Switzerland: 8.57%

Norway: 8.57%

Iceland: 8.57%

IGST: 5%/18%

CESS: Nil

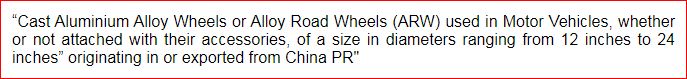

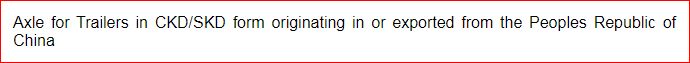

ADD:

N/N

04/2022

|

upto 23.01.2027 |

N/N

69/2021

|

upto 12.12.2026 |

UAE: 4.5%

Japan: Nil

Malaysia: 5% / 5%

SAFTA: 5%

Thailand : 5%

Vietnam : 5%

Myanmar : 5%

Indonesia : 5%

Brunei Darussalam : 5%

Lao People's Democratic Republic : 5%

Cambodia : 5%

Philippines : 5%

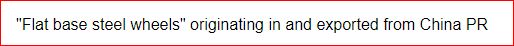

IGST: 5%/18%

CESS: Nil

UAE: 4.5%

Japan: Nil

Malaysia: 5% / 5%

SAFTA: 5%

Thailand : 5%

Vietnam : 5%

Myanmar : 5%

Indonesia : 5%

Brunei Darussalam : 5%

Lao People's Democratic Republic : 5%

Cambodia : 5%

Philippines : 5%