yyyyy

Customs Act 1962

Clearance of imported goods and

export goods

Section

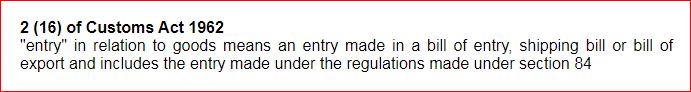

50. Entry of goods for exportation (Relevant

Updates)

*(1)

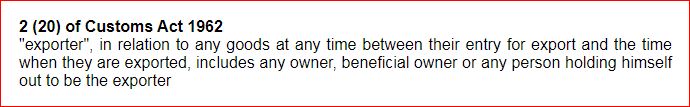

The exporter of any

goods shall make

entry

thereof by presenting 1[electronically]

4[on the customs automated system] to the

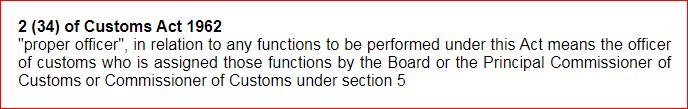

proper officer

thereof by presenting 1[electronically]

4[on the customs automated system] to the

proper officer

in the case of goods to be exported in a vessel or

aircraft

in the case of goods to be exported in a vessel or

aircraft

, a

shipping bill

, a

shipping bill

,

and in the case of goods to be exported by land, a

bill of export

,

and in the case of goods to be exported by land, a

bill of export

in the

5[in such form and manner as may be prescribed]

[helldodold[prescribed

form]helldod].

in the

5[in such form and manner as may be prescribed]

[helldodold[prescribed

form]helldod].

1[Provided

that the 3[Principal

Commissioner of Customs or Commissioner of Customs]

[helldodold[Commissioner

of Customs]helldod] may, in cases where it is not

feasible to make entry by presenting electronically

4[on the customs automated system], allow an

entry to be

presented in any other manner.]

(2) The exporter of any goods, while presenting

a shipping bill or bill of export, shall

[helldod2omit[at

the foot thereof]helldod] make and subscribe to a declaration as to the truth of its

contents.

4[(3) The

exporter

who presents a shipping bill or bill of export under this section shall

ensure the following, namely:''

who presents a shipping bill or bill of export under this section shall

ensure the following, namely:''

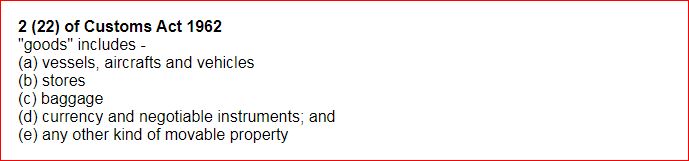

(a) the accuracy and completeness of the

information given therein;

(b) the authenticity and validity of any document

supporting it; and

(c) compliance with the restriction or

prohibition, if any, relating to the

goods

under this Act or under any other law

for the time being in force.]

under this Act or under any other law

for the time being in force.]

1. Inserted Vide

Section 45 of the Finance Act

2011

2. Omitted Vide

Section 45 of the Finance Act

2011

3. Substituted

Vide

Section 78 of the Finance Act 2014

4. Inserted Vide

Section 78 of Finance Act 2018

5. Substituted Vide

Section 78 of Finance Act 2018

thereof by presenting 1[electronically]

4[on the customs automated system] to the

proper officer

thereof by presenting 1[electronically]

4[on the customs automated system] to the

proper officer

in the case of goods to be exported in a vessel or

aircraft

in the case of goods to be exported in a vessel or

aircraft

, a

shipping bill

, a

shipping bill

,

and in the case of goods to be exported by land, a

bill of export

,

and in the case of goods to be exported by land, a

bill of export

in the

5[in such form and manner as may be prescribed]

[helldodold[prescribed

form]helldod].

in the

5[in such form and manner as may be prescribed]

[helldodold[prescribed

form]helldod].