(a) without limit by a 2[Principal Commissioner of Customs or Commissioner of Customs] [helldodold[Commissioner of Customs]helldod] or a Joint Commissioner of Customs;

3[*(b)

up to such limit, by such officers, as the

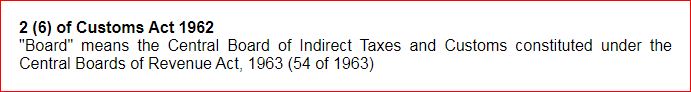

Board

may, by notification, specify]

may, by notification, specify]

[helldodold[(b) where the value of the goods liable to confiscation does not exceed 1[five lakh] [helldodold[two lakh]helldod] rupees, by an Assistant Commissioner of Customs or Deputy Commissioner of Customs;

(c) where the value of the

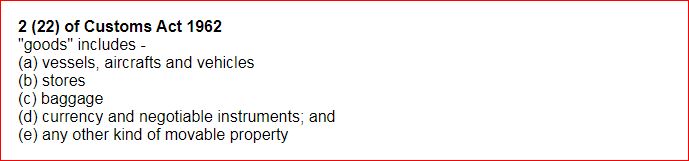

goods

liable to

confiscation does not exceed 1[fifty thousand]

[helldodold[ten thousand]helldod] rupees, by a Gazetted Officer of Customs lower in rank than an Assistant Commissioner of

Customs or deputy commissioner of custom]helldod]

liable to

confiscation does not exceed 1[fifty thousand]

[helldodold[ten thousand]helldod] rupees, by a Gazetted Officer of Customs lower in rank than an Assistant Commissioner of

Customs or deputy commissioner of custom]helldod]