(a) a local authority or other public body or association; or

(b) any authority of the State Government responsible for the collection of

value added tax or sales tax or any other tax relating to the

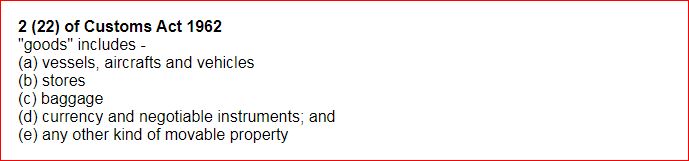

goods

or services;

or

or services;

or

(c) an income-tax authority appointed under the provisions of the Income- tax

Act, 1961;

(d) a Banking company within the meaning of clause (a) of section 45A of the

Reserve Bank of India Act, 1934; or

(e) a co-operative bank within the meaning of clause (dd ) of section 2 of the

Deposit Insurance and Credit Guarantee Corporation Act,1961; or

(f) a financial institution within the meaning of clause (c), or a non-banking

financial company within the meaning of clause (f), of section 45-I of the

Reserve Bank of India Act,1934; or

(g) a State Electricity Board; or an electricity distribution or transmission

licensee under the Electricity Act, 2003, or any other entity entrusted, as the

case may be, with such functions by the Central Government or the State

Government; or

(h) the Registrar or Sub-Registrar appointed under section 6 of the Registration

Act, 1908; or

(i) a Registrar within the meaning of the Companies Act, 2013; or

(j) the registering authority empowered to register motor vehicles under Chapter

IV of the Motor Vehicles Act, 1988; or

(k) the Collector referred to in clause (c) of section 3 of the Right to Fair

Compensation and Transparency in Land Acquisition, Rehabilitation and

Resettlement Act, 2013; or

(l) the recognised stock exchange referred to in clause (f) of section 2 of the

Securities Contracts (Regulation) Act, 1956; or

(m) a depository referred to in clause (e) of sub-section (1) of section 2 of

the Depositories Act, 1996; or

(n) the Post Master General within the meaning of clause ( j) of section 2 of

the Indian Post Office Act, 1898; or

(o) the Director General of Foreign Trade within the meaning of clause (d) of

section 2 of the

Foreign Trade (Development and Regulation) Act,1992; or

(p) the General Manager of a Zonal Railway within the meaning of clause (18) of

section 2 of the Railways Act,1989; or

(q) an officer of the Reserve Bank of India constituted under section 3 of the

Reserve Bank of India Act, 1934,