Quantum of penalty-

Penalties vs. Punishment Under GST: Where Do You Draw the Line?

Imagine this: A thriving business diligently files its GST returns, confident that everything is in order. But one misstep-perhaps an incorrect invoice or an unintentional tax shortfall-could lead to hefty fines or, in severe cases, even imprisonment. The GST framework is not just about tax collection; it’s a meticulously structured system that enforces compliance with clear-cut penalties and, in certain cases, criminal prosecution.

But where do we draw the line between a financial penalty and a criminal offence under GST? Is every violation punishable with imprisonment, or are there thresholds that determine when a simple fine turns into a legal battle?

This article breaks down GST offences, the penalties they attract, and when non-compliance crosses into criminal territory under Section 132 of the CGST Act. Let’s explore how businesses can navigate this complex landscape without facing severe repercussions.

Where Does a Fine End and a Legal Battle Begin?

The CGST Act, 2017, along with its rules, prescribes provisions for registration, tax determination, classification, valuation, and various mandatory compliances. Any breach of these laws leads to offences, which are clearly defined under the Act.

To ensure compliance, GST statutes codify offences and penalties in a detailed manner. Businesses may commit various offences that result in penalties and fines, acting as deterrents against fraudulent activities and non-compliance. Common GST offences include:

Evasion of taxes

Failure to register for GST

Issuance of incorrect invoices

Claiming excess Input Tax Credit (ITC)

The penalties for these offences range from monetary fines to imprisonment, depending on the severity of the violation. Sections 122 to 125 of the CGST Act cover offences and penalties, while Section 132 governs prosecution for serious violations, with imprisonment ranging from six months to five years based on the amount of tax evaded. The Act also allows for the compounding of offences under Section 138, subject to prescribed conditions.

Breaking the Rules: Offences and Penalties Under GST

While the CGST Act, 2017, does not explicitly define the term ‘offence,’ it prescribes provisions detailing violations and their corresponding Thus, an offence refers to any breach of the Act or its rules, attracting penalties such as tax liabilities and monetary fines. Section 122 of the CGST Act enumerates 21 such offences, applicable to taxable persons, whether registered or liable for registration. This section outlines the statutory consequences of these violations, including the obligation to pay tax, interest, and penalties. Sub-section (1) specifically lists these offences, which are as follows:

(i) Supplies goods/services without an invoice or with a false or incorrect invoice

(ii) Issues an invoice/ bill without an actual supply.

(iii) Collects tax but fails to pay to the Government within three months from the due date.

(iv) Collects tax in contravention of the Act but fails to pay within three months from the due date.

(v) No deduction or lower deduction or fails to pay, the tax deducted under Section 51.

(vi) Non collection or lower collection or fails to pay, the tax collected under Section 52.

(vii) Avails or utilizes ITC without actual receipt of goods/services.

(viii) Fraudulently claims a tax refund.

(ix) Availing/ Distributes ITC in violation of Section 20 or relevant rules.

(x) Falsifies financial records or submits fake accounts/documents/ false information to evade tax.

(xi) Fails to obtain GST registration despite of being liable.

(xii) Provides false registration details either at the time of applying for registration or subsequently

(xiii) Obstructs/ prevents a GST officer in duty.

(xiv) Transports taxable goods without proper documents.

(xv) Suppresses turnover to evade tax.

(xvi) Fails to keep, maintain or retain books of accounts/ documents as required.

(xvii) Fails to furnish required or submits false information/ documents during any proceeding;

(xviii) Supplies, transports, or stores goods liable for confiscation.

(xix) Issues invoices/ document using another person’s GSTIN.

(xx) Tampers with or destroys material evidence or documents.

(xxi) Disposes of or tampers with detained/seized/attached goods.

|

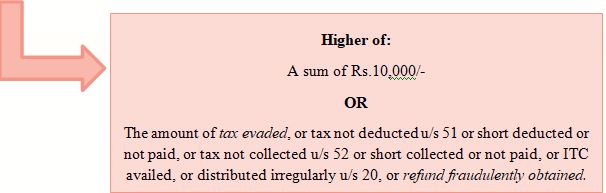

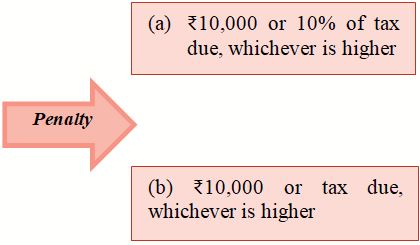

Quantum of penalty- |

|

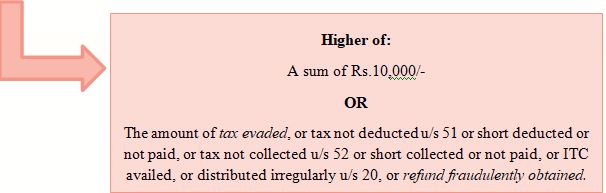

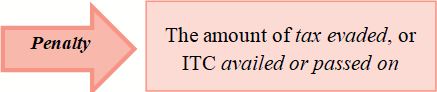

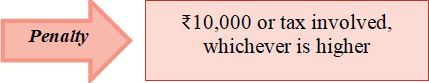

Additional penalties u/s 122

|

|

|

|

|

|

|

|

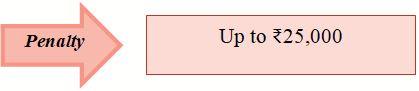

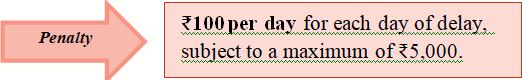

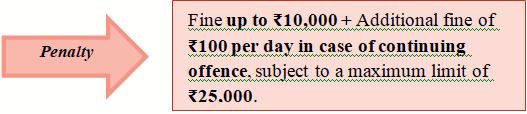

Additional GST Offences and Penalties

|

Failure to Register Machines: Consequences Under Section 122A |

|

| Who is covered? | Manufacturers of goods where a special procedure for machine registration is notified u/s 148. |

| What is the violation? | Failure to register machines as per the notified special procedure. |

| Penalty per machine | Rs.1,00,000 for each unregistered machine, in addition to any other applicable penalties. |

| Additional Consequence | Unregistered machines are liable for seizure and confiscation. |

| Relief from Confiscation |

Confiscation can be avoided if: ✓ The penalty imposed is paid. ✓ The machine is registered within 3 days of receipt of communication of the penalty order. |

|

|

|

|

|

|

Penalty or Confiscation? That’s Not the End! (Section 131, CGST Act)

Think a penalty or confiscation is the worst that can happen? Not quite! Even if your goods are seized or penalties are imposed under this Act, it doesn’t shield you from further legal consequences.

If another provision of the CGST Actor any other law prescribes additional punishment, you’ll still be held liable. Plus, the application of the Code of Criminal Procedure, 1973, remains unaffected, meaning prosecution and other legal actions can still follow.

Now that we know penalties and confiscation aren’t the end of the road, let’s dive into punishments for serious GST offences under Section 132- where fines turn into prison time.

The Road to Imprisonment: Serious GST Offences

Not all GST violations end with just a fine-some lead to criminal prosecution and even imprisonment. Section 132 of the CGST Act deals with the most serious offences, ensuring fraudsters face strict legal consequences. This section primarily targets fraud, tax evasion, and deliberate misconduct, prescribing imprisonment based on the gravity of the violation.

What Does Section 132 Cover?

Section 198 of the Criminal Procedure Code defines “prosecution” as the institution and carrying on of legal proceedings against a person. It is the process of exhibiting formal charges against the offender.

Section 132 of the CGST Act codifies 12 major offences that warrant criminal prosecution, including:

a) Supplies goods or services without issuing an invoice, violating GST provisions, with the intention to evade tax.

b) Issues an invoice or bill without actual supply, leading to wrongful ITC availment or tax refund.

c) Fraudulently avails ITC using a false invoice or without any invoice.

d) Collects tax but fails to pay it to the government within three months of the due date.

e) Evades tax or fraudulently obtains a refund, not covered under clauses (a) to (d).

f) Falsifies records, produces fake documents, or provides false information to evade tax.

g) …….omitted………..

h) Deals with goods liable for confiscation, including possession, transport, removal, storage, or supply.

i) Engages in or facilitates the supply of services in violation of GST provisions.

j) …….omitted………..

k) …….omitted………..

l) Attempts to commit or assists in committing any of the offences mentioned above.

Scheme of Punishment

| Offence Amount / Nature | Punishment |

| (i) Tax evaded, wrongful ITC availed/utilized, or refund wrongly taken exceeds Rs.500 lakhs | Imprisonment up to 5 years + Fine |

| (ii) Tax evaded, wrongful ITC availed/utilized, or refund wrongly taken exceeds Rs.200 lakhs but ≤ Rs.500 lakhs | Imprisonment up to 3 years + Fine |

| (iii) Clause (b) offence where tax evaded, wrongful ITC availed/utilized, or refund wrongly taken exceeds Rs.100 lakhs but ≤ Rs.200 lakhs | Imprisonment up to 1 year + Fine |

| (iv) Committing or abetting an offence under clause (f) | Imprisonment up to 6 months or Fine or both |

Cognizable vs. Non-Cognizable Offences Under GST

GST offences are categorized as either cognizable & non-bailable or non-cognizable & bailable, as laid down in sub-sections (4) & (5) of Section 132:

“(4) Notwithstanding anything contained in the Code of Criminal Procedure, 1973, all offences under this Act, except the offences referred to in sub-section (5) shall be non-cognizable and bailable.

(5) The offences specified in clause (a) or clause (b) or clause (c) or clause (d) of subsection (1) and punishable under clause (i) of that sub-section shall be cognizable and non-bailable.”

Cognizable offence (Section 2(c) of the Criminal Procedure Code, 1973 (CrPC)) -A cognizable offence is one that is punishable with death, life imprisonment, or imprisonment. In such cases, the police have the authority to arrest the accused without a warrant and can also initiate an investigation without prior approval from the court. These offences are generally more serious in nature and are often non-bailable, meaning bail is not granted as a matter of right and must be sought from the court.

Non-cognizable offence (Section 2(l), CrPC) - Non-cognizable offences are less serious. In such cases, the police cannot arrest the accused without a warrant and require prior approval from the court to begin an investigation. These offences are usually bailable, meaning the accused has the right to obtain bail from the police or court.

Now, let’s see how this applies under GST:

| Category | Offences Covered | Tax Amount Involved (Rs.) | Cognizability | Bailability |

| General Offences | All offences under the Act, except those in sub-section (5) | Any amount (except as below) | Non-Cognizable | Bailable |

| Serious Offences | Non-Issuance of invoice, tax evasion, wrongful ITC/refund (Clauses a, b, c, d of sub-section 1) | More than Rs.5 crore | Cognizable | Non-Bailable |

Settle It Before Trial: Compounding of Offences Under GST

GST law imposes strict penalties for violations, including criminal prosecution in serious cases. However, it also provides an alternative route for offenders to settle certain offences without facing a full trial. This is known as compounding of offences-where the accused can pay a prescribed amount to close the matter and avoid further legal proceedings. But not all offences are eligible, and the process comes with specific conditions.

Section 138 of the CGST Act and Rule 162 of the CGST Rules, lays down the framework for compounding, allowing it both before and after prosecution is initiated. While the GST law does not define “compounding,” Black’s Law Dictionary explains it as “to agree for consideration not to prosecute (a crime).” Further, Compounding is recognized under Section 320 of the Code of Criminal Procedure and functions as a settlement mechanism that prevents lengthy court battles. It offers a practical solution for businesses and individuals who seek to resolve disputes efficiently while adhering to tax laws.

In simple terms, it refers to a legal settlement where an offender pays a penalty instead of facing prosecution. Essentially, it acts as a middle ground between the state and the accused-ensuring compliance and revenue collection while sparing the accused from criminal proceedings.

Now, let’s delve into how compounding works, its eligibility, and its implications for businesses facing GST-related legal troubles.

Offences Eligible for Compounding:

As per section 138(1) of the CGST Act 2017,

Any offence under the GST Act can be compounded before or after the institution of prosecution.

The Commissioner has the authority to compound offences.

The accused must pay the compounding amount to the Central or State Government.

Compounding must be done as per the prescribed manner under the GST Act.

When Compounding Isn’t an Option

Not every offence under GST can be settled through compounding. First Proviso of Section 138(1) of the CGST Act 2017 lays down clear restrictions:

Repeat Offenders - If you've already compounded offences specified under Section 132(1)(a) to (f), (h), (i) and (l) before, you can’t do it again for the same types of violations.

Fake Invoices & Bogus ITC - If you’ve been accused under Section 132(1)(b) for issuing invoices without actual supply, leading to wrongful ITC availment or refund, compounding is strictly prohibited.

Court Convictions - If a court has already convicted you under this Act, compounding is no longer an option.

Other Prescribed Cases - The government may specify other classes of persons or offences that are ineligible for compounding through rules or notifications.

Note:

➣ Compounding under GST does not shield you from other legal proceedings. Even if an offence is compounded under this section, itwill not affect proceedings under any other law.

➣ Full Payment is a Must. Compounding will be allowed only after the payment of tax, interest, and penalty involved in the offence.

Compounding Amount

➣ As per Section 138(2) of the CGST Act, the compounding amount shall be as prescribed under the law.

➣ Minimum Amount: Not less than 25% of the tax involved.

➣ Maximum Amount: Not more than 100% of the tax involved.

✓Finality of Compounding

As per Section 138(3) of the CGST Act, once the compounding amount determined by the Commissioner is paid, no further proceedings can be initiated under this Act for the same offence. Additionally, any ongoing criminal proceedings related to the offence shall stand abated.

How Does Compounding Work? A Step-by-Step Guide (Rule 162 of the CGST Rules)

With the statutory framework of compounding established under Section 138, the next crucial aspect is the procedure that governs its implementation. Rule 162 of the CGST Rules lays down the step-by-step process for compounding of offences, ensuring uniformity and transparency in granting compounding relief. Let’s break down the procedural requirements and key conditions under Rule 162.

1. Filing the Application

If you're facing prosecution under GST, you can apply for compounding using FORM GST CPD-01.

This can be done before or after prosecution starts.

The application must be submitted to the Commissioner.

2. Review by the Commissioner

3. Decision Time: Approve or Reject?

The Commissioner, after reviewing the facts, may either:

✓Approve your application and issue an order in FORM GST CPD-02, indicating the compounding amount and granting immunity from prosecution.

✕Reject your application (within 90 days of the receipt of the application), but only after giving you a chance to be heard and recording the grounds of such rejection.

4. Pay Up!

5. Mandatory Payments Before Compounding

You must first clear all tax, interest, and penalties before compounding is allowed.

6. Final Payment & Closure ✓

7. What If You Hide Facts?

Compounding Amount Calculation (Rule162(3A))

| S.no. | Offence specified in Section 132 (1) of the Act | Compounding amount if offence is punishable under clause (i) of sub-section (1) of section 132 | Compounding amount if offence is punishable under clause (ii) of sub-section (1) of section 132 |

| 1 | clause (a) | Up to 75% of the amount of tax evaded or the amount of ITC wrongly availed or utilised or the amount of refund wrongly taken, subject to minimum of 50% of such amount.. | Up to 60% of the amount of tax evaded or the amount of ITC wrongly availed or utilised or the amount of refund wrongly taken, subject to minimum of 40% of such amount. |

| 2 | clause (c) | ||

| 3 | clause (d) | ||

| 4 | clause (e) | ||

| 5 | clause (f) | Amount equivalent to 25% of tax evaded. | Amount equivalent to 25% of tax evaded. |

| 6 | clause (h) | ||

| 7 | clause (i) | ||

| 8 | Attempt to commit the offences or abets the commission of offences mentioned in clause (a), (c) to (f) and clauses (h) and (i) of subsection (1) of section 132 of the Act | Amount equivalent to 25% of such amount of tax evaded or the amount of ITC wrongly availed or utilised or the amount of refund wrongly taken. | Amount equivalent to 25% of such amount of tax evaded or the amount of ITC wrongly availed or utilised or the amount of refund wrongly taken. |

Since we’ve already explored penalties above, it's important to note that the government has laid down specific guidelines for officers to follow before levying a penalty, ensuring fairness and just practices. Now, let's delve into these guidelines, which are clearly outlined in Section 126 of the CGST Act.

Section 126: General Disciplines Related to Penalty

Penalties play a vital role in ensuring compliance with tax laws under the GST regime. However, these penalties must be applied fairly, consistently, and in proportion to the severity of the offence. Section 126 of the CGST Act sets out a clear framework for imposing penalties while ensuring that they are just and reasonable.

Key Principles of Section 126:

❖ Minor Mistakes, No Big Penalties: If you’ve made a small, easily fixable mistake-like an obvious error in your documentation or a minor breach with tax involved less than Rs.5,000-don’t worry! No heavy penalties will be imposed, as long as there was no fraud or gross negligence involved. Mistakes happen, but they won’t cost you big time!

❖ Penalties Must Fit the Crime: The penalty isn’t one-size-fits-all. It should reflect the severity and specifics of the breach. So, the more serious the issue, the more severe the penalty-but nothing unfair or over the top.

❖ A Chance to Explain: The law is all about fairness. Before any penalty is slapped on you, the officer must give you the opportunity to explain yourself. No surprises or sudden punishments here!

❖ Clarifying the Breach: Whenever a penalty is issued, the officer must clearly specify what the breach was and which law or regulation triggered the penalty. Transparency is key.

❖ Self-Disclosure as a Positive: Here’s a chance to lighten your penalty! If you come forward voluntarily and disclose the breach before the officer catches on, it’ll be seen as a mitigating factor-meaning the penalty could be reduced.

❖ Fixed Penalties Don't Apply Here: If the penalty is already set at a fixed sum or percentage, these rules don’t apply. It’s straightforward and doesn’t leave room for flexibility.

In short, Section 126 is designed to ensure fairness, especially when it comes to small errors or oversights. It's all about balance: penalties that match the nature of the breach, and a process that gives you a chance to be heard.

Disclaimer: The information given in this article is solely for purpose of understanding the law. It is completely based on the interpretation of the author and cannot be constituted as a legal advise, the author of this article and Lawcrux team is not responsible for any legal issues if arises on the basis of the interpretation given above.